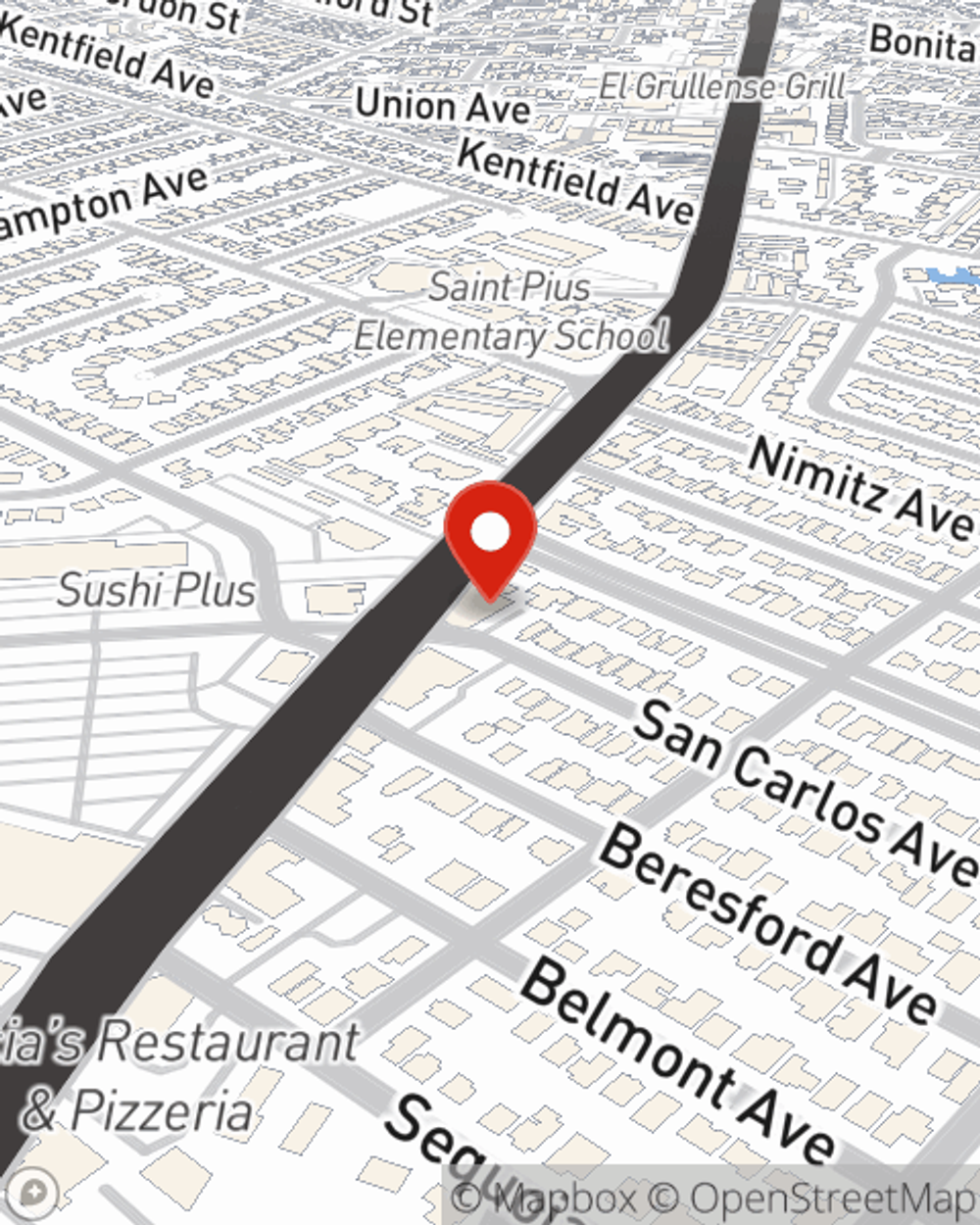

Condo Insurance in and around Redwood City

Unlock great condo insurance in Redwood City

Protect your condo the smart way

Your Stuff Needs Coverage—and So Does Your Townhome.

When looking for the right condo, it's understandable to be focused on details like neighborhood and location, but it's also important to make sure that your condo is properly insured. That's where State Farm's Condo Unitowners Insurance comes in.

Unlock great condo insurance in Redwood City

Protect your condo the smart way

Condo Unitowners Insurance You Can Count On

With this coverage from State Farm, you don't have to be afraid of the unanticipated happening to your unit and personal property inside. Agent Charlotte Russell can help inform you of all the various options for you to consider, and will assist you in building a dependable policy that's right for you.

If you're ready to bundle or find out more about State Farm's great condo insurance, call or email agent Charlotte Russell today!

Have More Questions About Condo Unitowners Insurance?

Call Charlotte at (650) 369-7900 or visit our FAQ page.

Simple Insights®

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.

Charlotte Russell

State Farm® Insurance AgentSimple Insights®

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.